Optimise Returns, Minimise Risks

Digital assets risk-adjusted yields for institutions.

Less than 10% of crypto wallets are optimised...

Let's ensure you're NOT part of the 90%.

Digital assets portfolio optimization

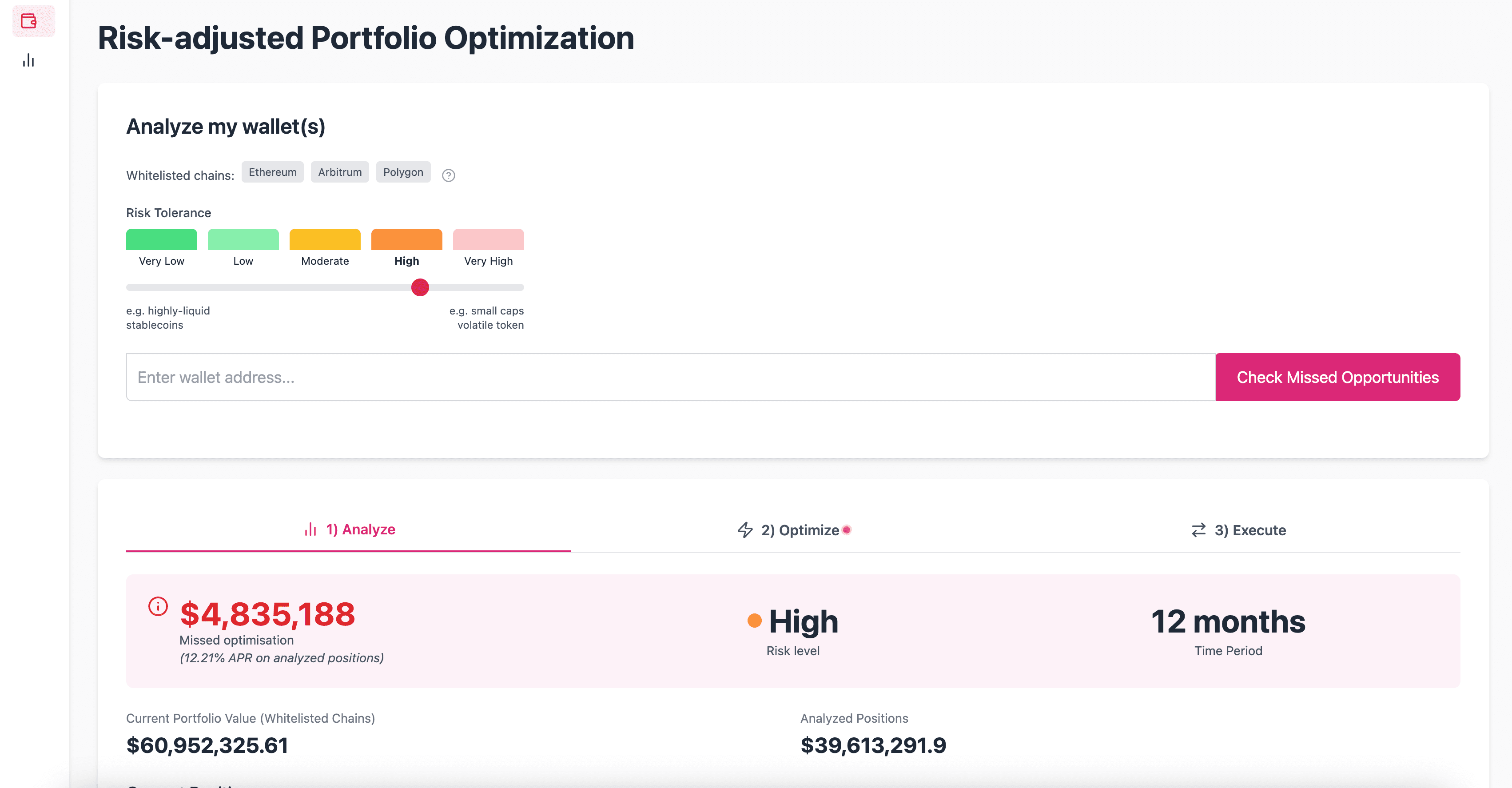

Our solution analyses wallets' positions and transactions history to identify attractive yield opportunities, combined with a robust risk framework. This helps institutions optimise their digital asset portfolios through on-chain and off-chain data intelligence, finding yield and rebalancing opportunities that match their risk tolerance.

LYRA: Layered Yields' Risks Assessment framework

Our proprietary framework, LYRA, brings structure to digital assets risks assessment. It allows investors to compare opportunities on a standardized methodology and make confident, informed decisions. We have more than 30 live models covering a wide range of risk factors and structured into layers and sub-categories.

Use Cases

"Risk-Positive" - Crypto Investors

Investors seeking alpha need the following, although this infrastructure is not yet available, nor in one place:

- Standardized and optimized data feeds

- Comprehensive screening tools across investment opportunities

- Best execution

Solution

Our APIs, unique data feeds, and analysis tools, together with best execution routing, help institutional investors augment their revenue opportunities, allowing them to make informed investment decisions and execute trades efficiently.

"Defensive" - Treasury Managers

Don't have the time or knowledge to be a 24/7 quant, yet carry the pressure of protecting a portfolio's assets while facing expectations to generate returns.

Need to manage a portfolio of digital assets in a low-risk way, yet still achieving optimal returns.

Solution

Our solution consolidates digital assets from all wallets into a unified visual portfolio. It scans the entire ecosystem, leveraging high-quality data sources to build optimized models that provide Treasury Managers with risk-adjusted, executable strategies.

"Full-on' - B2B2C

Clients often underutilize exchanges' 'Earn' features due to complexity and overwhelming choices, resulting in lost returns and commissions. Meanwhile, exchanges provide sub-optimal yield strategies, failing to maximize potential earnings for both clients and themselves.

Solution

Offers your clients an easy, yet intelligent, way to enhance portfolio returns, leading to better platform/client relationships, more transactions, and higher ROI.

Bespoke Risk Reports

Our detailed risk reports provide institutional-grade analysis of digital asset opportunities. Each report combines quantitative metrics with qualitative insights to give you a complete picture of the risk-reward profile and optimisation status of your portfolio.

- Detailed yield optimization strategies

- In-depth risk assessments on chains, assets, protocols and more

- Executable insights

- Don't miss any opportunity

Risk Assessment Report

Yield Optimization Analysis

Leadership Team

Chris Thomas

Chris is a serial entrepreneur and seasoned fintech leader who drove 17x crypto revenue growth at a Swiss Bank. He previously founded a crypto custodian and has run European Innovation at Fidelity Investments. Chris bringing deep expertise in both traditional finance and digital assets and a very substantial global network of crypto-natives and tradfi.

Clement Felley

Clement is a quantitative investment manager experienced in leading large equity strategies. He brings deep DeFi expertise, having previously founded a DeFi aggregator backed by major industry players, working notably with lending, market-making, and derivative protocols. Clement is also a CFA charterholder.

Team & Advisors

We are supported by leaders in technology & financial services. We have an additional Quant with 5 years experience in financial markets and our tech stack has been architected by a 30-year banking veteran who has been in crypto for 7 years.

Some of the companies our team have previously worked with

Accomplished leadership team, with deep experience across financial services, technology and building businesses – Active in crypto and blockchain since 2016